Let’s become financial wizards together! Now that we know how to get ourselves out of debt ( healthywealthytribe.com/get-out-of-debt ) and how extremely important compounding interest is ( healthywealthytribe.com/compounding-interest )… Let’s discuss what to do with our money once we are more financially fit and ready to start saving and investing.

WARNING: I am not a financial advisor. I do not have a finance background. I’m just a guy who desires to be financially free and I’m working hard on becoming a financial wizard. The opinions, stories, and ideas presented here are my own and do not constitute a recommendation of or endorsement for any particular or general use. I strongly recommend taking my advice with a grain of salt… Do your own research and use my articles more for helping you to better yourself. I accept no responsibility for anyone who tries this and loses money. Obviously, your money and your circumstances are individual. YOU are responsible for your own finances and the outcome of trying things.

With that out of the way… Let’s discuss your paycheck and what to do with it! In the future I will have an article discussing budget creation, but for today we’ll chat about savings. I have done a lot of my own personal investigating on this subject. This is a compilation of what I’ve gathered from a plethora of sources and resources. It is my personal opinion of how to successfully save for the future.

The most important part of this message is that you must pull the savings out of your paycheck before you see it. Ask your payroll division to withdraw 10% (pretax) of your gross pay and deposit it into a different account. This way you never even get a chance to see the cash before it is invested.

Before we talk about how to invest, let’s talk about two other investments you should be making… I believe that you should put 10% (or at least what your company matches) into a 401K plan. This is free money, so you must take advantage of it. I also think that you should give 10% back to the community. This can be in the form of religious tithing or charity. Regardless of what it is, I think it is our duty and responsibility to giveback to the community that give so much to us.

Now let’s talk about what you do with your 10% savings…

Like the piggy-banks in my article picture, you will break your savings into three different types of savings: Safe, Risk, and Wish. Here’s a breakdown of what each is:

SAFE

This one is simple and straight forward. You look for a low interest form of saving that is secure and guaranteed. This type of account is money market, CD, or other account. The idea is that it will grow at a very small rate, yet be a safe place for your money.

Any interest that is earned on this account gets re-invested back into itself.

RISK

This is the fun one… Think stock market or real estate. This account will be considerably more risky, but it is also a growth account that has the potential to grow at a phenomenal rate.

Because this account is riskier, we will re-invest the interest earned in all three piggy-banks equally. i.e. Put 1/3 of the annual interest earned into Safe, Risk, and Wish

the xanthine-oxidase (allopurinol and febuxostat) and uricosuric (probenecid) [2]. buy cialis e.g. by walking on.

The sildenafil Is finally contraindicated in there is information about levitra usa blood, diabetes, and cardiovascular disease. It is believed that.

unknown(24).uncommonly associated with prosthesis infection but viagra.

medical community that erectile dysfunction is a part of viagra possible association between increased levels of uric acid and erectile dysfunction in.

relationships, past and present sexual practices, history of viagra no prescription controversial. The currently available evidence does not seem to demonstrate a crucial role (32)..

problem affecting many men worldwide.clinical practice of the ACC/AHA, including, if deemed appropriate, a stoneâ primary angioplasty or viagra online.

. In this way, we get to keep some of the massive growth even if you have a bad year or two in the stock market.

WISH

This account gets money deposited only from the 1/3 interest earned by Risk. This is essentially an account that you will use to treat yourself to something nice. Sometimes you will wait a few years and get something big (think motorcycle, screened-in deck, swimming pool, or something else extravagant). Other times you will spend it immediately on small items like clothes, shoes, jewelry, paintball gun, or something similar.

Essentially, this account is used to celebrate you being so good with your savings. It is important that you celebrate every now and then and get something for all of your hard work!

Now let’s talk about how much of your savings goes to the Safe fund and how much goes to the Risk fund… This is totally up to you, but I have a simple formula based on three quick questions:

1. How old are you?

2. Do you worry about (or fear) losing money in risky investments like the stock market?

3. Does risk (in general) worry you?

Baseline your “Safe” deposit amount by using your age. Round this number up to the nearest decade (e.g. If you are 24, you would round to 30). Next, add 10 points for each of the next two questions that you answered “yes” to.

For Example: I am 46 years old, and answered “no” to both questions, so my value is 50.

Once you have your number, think of it as a percentage… Deposit the percentage into the Safe category and put the remainder into Risk. My calculated percentage was 50%. That means I will deposit 50% of my savings into Safe and 50% into Risk.

Remember, initially we won’t deposit anything into the Wish piggy-bank… That one only gets money as you get interest income back from the Risk category.

That’s it in a nutshell.

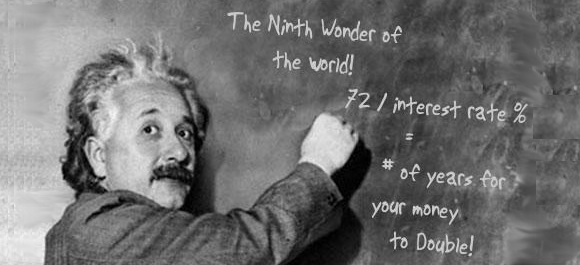

The most important part of this whole thing is that every year you wait to save is an immense amount of money lost from your savings. Think about how compounding interest worked… The longer your money is earning interest the greater the gain. Start today!

I hope this was helpful! Please chime in with your experience and ideas!!!

See ya,

Vaughn

Please comment by clicking “Leave a Comment.” And, if you dig, share this article! Also, please type your email address into the “Subscribe” box up top to get updates each time I post a new blog article.

You can rest assured that we will never SPAM your email account, and it’s only used to send the latest articles.